Bitcoin is a Bubble !

Is bitcoin a bubble?

As per the legit standards and recent updates, it is significant for all the forex traders who trades foreign currencies to know that bitcoin is breaking through $15000 milestone and therefore it has been rising by more than $1,000 a week for several weeks, for now, expectations are nevertheless higher that will definitely soar to rise. This is one of the big reasons that people, especially traders are going crazy for the concept of cryptocurrencies. Therefore, this also helps to know as to how an investor should invest in bitcoin and other cryptocurrencies such as Ethereum, Ripple and Litecoin.

Cryptocurrencies are actually blockchain based. The blockchain is based on the idea of decentralization, using distributed, public ledger payments technology. If it proves to be as efficient, scalable, and secure as its advocates claim, it could seriously disrupt the legacy payment systems that are currently operated by banks, in the same way as the internet has disrupted traditional media, communication and advertising. The main idea of a blockchain is that the previously powerful intermediaries become redundant in making transactions, deals and transferring money. It is no longer necessary to use a bank or other payment service-provider.

Therefore, bitcoin is actually in a bubble. From few of the examples that we know:

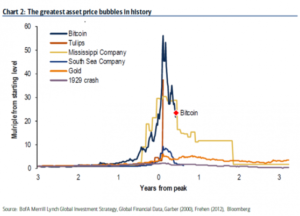

The most known as far and the most disruptive developments in technology and finance eventually inflate into speculative bubbles as investors and traders assume that the intrinsic value of these new vehicles will expand forever. Say, the “Tulip Mania” in Holland in the 1630s to which Dimon alluded notwithstanding, history is replete with examples of how transformational technologies enter a highly speculative phase, leading to the creation of great riches for early investors but great risks for those who arrive at the party far too late.

Another great example that stands out is, the exploration of the New World led to the catastrophic “South Sea Bubble” in Great Britain in the 18th century, along with the “Mississippi Scheme” in France at roughly the same time.

Now, the price of a single bitcoin has gone up parabolically and rather at a very faster pace than any other speculative vehicle in the history of the trading market so far, as investor enthusiasm for the new medium has reached a fever pitch. However, its adoption as a global currency is suspect, partly for regulatory reasons and partly because creating a world currency from scratch, especially if given the mandatory limitations on bitcoin creation.